Page 38 - Δημήτρης Λουκιδέλης - Μεταφράσεις Νομικών, Συμβολαιογραφικών & Δημοσίων Εγγράφων - Δείγματα Μεταφράσεων

P. 38

38/115

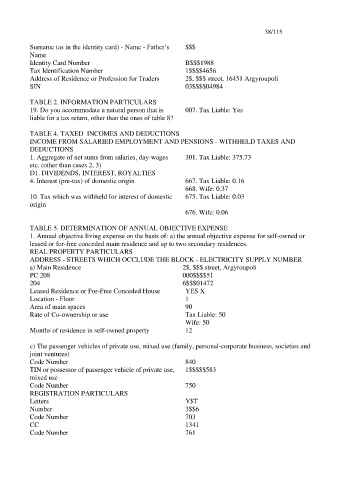

Surname (as in the identity card) - Name - Father’s $$$

Name

Identity Card Number B$$$1988

Tax Identification Number 1$$$$4656

Address of Residence or Profession for Traders 2$, $$$ street, 16451 Argyroupoli

SIN 03$$$$04984

TABLE 2. INFORMATION PARTICULARS

19. Do you accommodate a natural person that is 007. Tax Liable: Yes

liable for a tax return, other than the ones of table 8?

TABLE 4. TAXED INCOMES AND DEDUCTIONS

INCOME FROM SALARIED EMPLOYMENT AND PENSIONS - WITHHELD TAXES AND

DEDUCTIONS

1. Aggregate of net sums from salaries, day-wages 301. Tax Liable: 375.73

etc. (other than cases 2, 3)

D1. DIVIDENDS, INTEREST, ROYALTIES

4. Interest (pre-tax) of domestic origin 667. Tax Liable: 0.16

668. Wife: 0.37

10. Tax which was withheld for interest of domestic 675. Tax Liable: 0.03

origin

676. Wife: 0.06

TABLE 5. DETERMINATION OF ANNUAL OBJECTIVE EXPENSE

1. Annual objective living expense on the basis of: a) the annual objective expense for self-owned or

leased or for-free conceded main residence and up to two secondary residences.

REAL PROPERTY PARTICULARS

ADDRESS - STREETS WHICH OCCLUDE THE BLOCK - ELECTRICITY SUPPLY NUMBER

a) Main Residence 2$, $$$ street, Argyroupoli

PC 208 000$$$$51

204 6$$$01472

Leased Residence or For-Free Conceded House YES X

Location - Floor 1

Area of main spaces 90

Rate of Co-ownership or use Tax Liable: 50

Wife: 50

Months of residence in self-owned property 12

c) The passenger vehicles of private use, mixed use (family, personal-corporate business, societies and

joint ventures)

Code Number 840

TIN or possessor of passenger vehicle of private use, 1$$$$$583

mixed use

Code Number 750

REGISTRATION PARTICULARS

Letters Y$T

Number 3$$6

Code Number 703

CC 1341

Code Number 761