Page 85 - Δημήτρης Λουκιδέλης - Μεταφράσεις Νομικών, Συμβολαιογραφικών & Δημοσίων Εγγράφων - Δείγματα Μεταφράσεων

P. 85

85/115

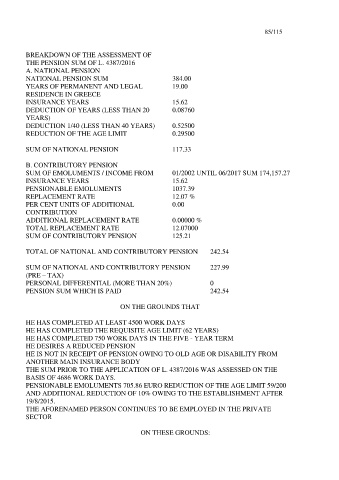

BREAKDOWN OF THE ASSESSMENT OF

THE PENSION SUM OF L. 4387/2016

A. NATIONAL PENSION

NATIONAL PENSION SUM 384.00

YEARS OF PERMANENT AND LEGAL 19.00

RESIDENCE IN GREECE

INSURANCE YEARS 15.62

DEDUCTION OF YEARS (LESS THAN 20 0.08760

YEARS)

DEDUCTION 1/40 (LESS THAN 40 YEARS) 0.52500

REDUCTION OF THE AGE LIMIT 0.29500

SUM OF NATIONAL PENSION 117.33

Β. CONTRIBUTORY PENSION

SUM OF EMOLUMENTS / INCOME FROM 01/2002 UNTIL 06/2017 SUM 174,157.27

INSURANCE YEARS 15.62

PENSIONABLE EMOLUMENTS 1037.39

REPLACEMENT RATE 12.07 %

PER CENT UNITS OF ADDITIONAL 0.00

CONTRIBUTION

ADDITIONAL REPLACEMENT RATE 0.00000 %

TOTAL REPLACEMENT RATE 12.07000

SUM OF CONTRIBUTORY PENSION 125.21

TOTAL OF NATIONAL AND CONTRIBUTORY PENSION 242.54

SUM OF NATIONAL AND CONTRIBUTORY PENSION 227.99

(PRE – TAX)

PERSONAL DIFFERENTIAL (MORE THAN 20%) 0

PENSION SUM WHICH IS PAID 242.54

ON THE GROUNDS THAT

HE HAS COMPLETED AT LEAST 4500 WORK DAYS

HE HAS COMPLETED THE REQUISITE AGE LIMIT (62 YEARS)

HE HAS COMPLETED 750 WORK DAYS IN THE FIVE - YEAR TERM

HE DESIRES A REDUCED PENSION

HE IS NOT IN RECEIPT OF PENSION OWING TO OLD AGE OR DISABILITY FROM

ANOTHER MAIN INSURANCE BODY

THE SUM PRIOR TO THE APPLICATION OF L. 4387/2016 WAS ASSESSED ON THE

BASIS OF 4686 WORK DAYS.

PENSIONABLE EMOLUMENTS 705.86 EURO REDUCTION OF THE AGE LIMIT 59/200

AND ADDITIONAL REDUCTION OF 10% OWING TO THE ESTABLISHMENT AFTER

19/8/2015.

THE AFORENAMED PERSON CONTINUES TO BE EMPLOYED IN THE PRIVATE

SECTOR

ON THESE GROUNDS: